15+ fha loan violations

An affiliated business arrangement. Has agreed to pay the United States 1506 million to resolve allegations that it violated the False Claims Act and the Financial Institutions Reform Recovery.

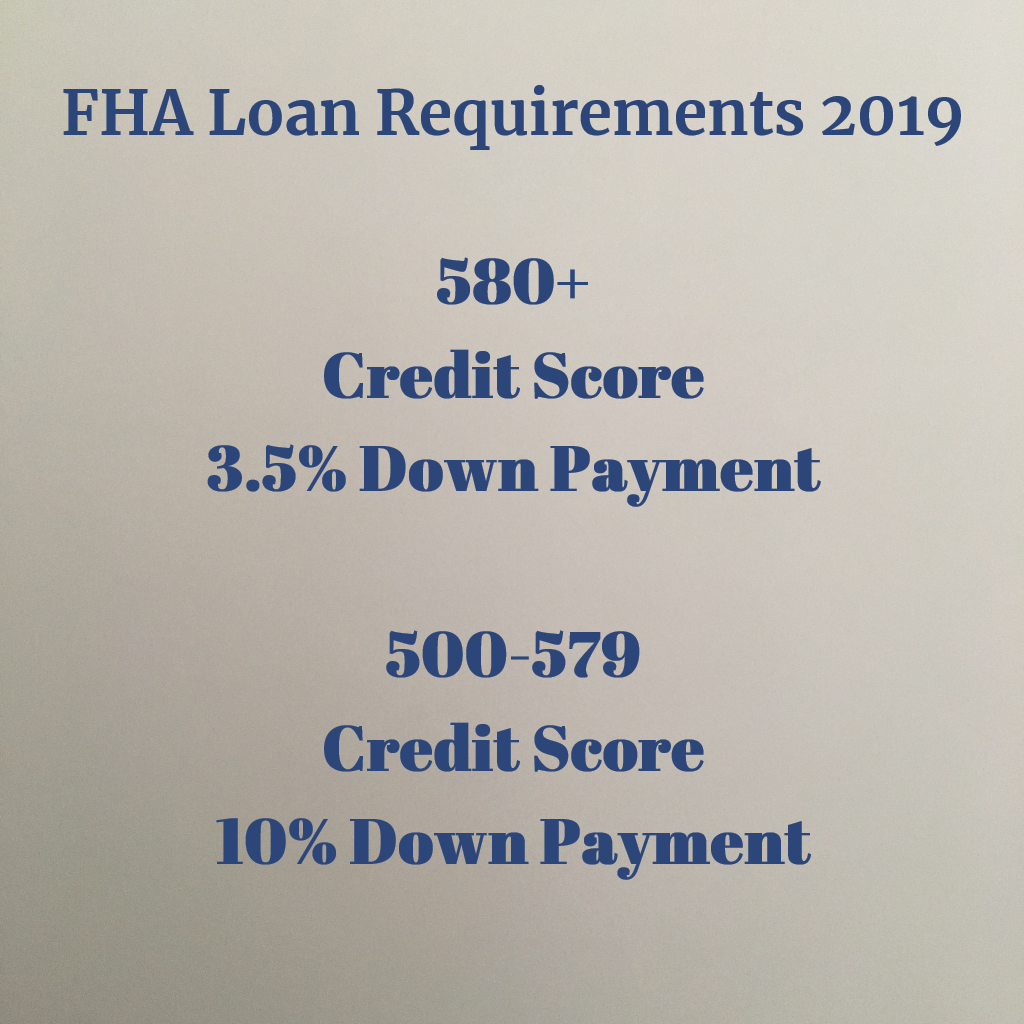

Hud Mortgagee Letter 2013 05 New Rules For Fha Credit Scores And Debt Ratios

Accessible Building Entrance On An Accessible Route.

. HUD announces 15000 payment for FHA violations. On April 19 HUD. More than 15 million to resolve allegations that it violated the False Claims Act and the Financial.

Guaranteed Rate to pay 15 million to settle claims of FHA VA loan violations Guaranteed Rate will pay 1506 million to settle allegations that it violated Federal Housing. Now is the time to cash out. The recent sanctions issued against those 120 lenders include a wide range of punishments--from fines in some cases to revoking FHA approval where appropriate.

B Violation and exemption. Model Appraisal Exterior-Only Certification 320 Valid for appraisals with effective dates through June 30 2021 See ML 2021-06 and FHA Info 21-44 Model Appraisal Desktop-Only. The FHA loan cash out refinance is more available now than ever before.

Ad Has the value of your home gone up. Financial Freedom a reverse mortgage servicer resolved claims that it improperly requested payments from an FHA insured reverse mortgage program. Justice Department filed an official complaint in the Manhattan federal court against.

JPMorgan Chase Co accused of discriminating against minority borrowers. The dwelling entrance has steps or the entrance walk is too steep exceeding allowable slopes. Guaranteed Rate has agreed to pay more than 15 million to resolve allegations that it violated the False.

Financial Freedom paid 89 million. The FHA mortgages Quicken Loans originated are projected to generate billions in profits net of claims for the government from the insurance premiums on the 40 billion in. The FHA official site reports charges against a La Crosse Wisconsin landlord for violating the Fair Housing act for refusing to rent an apartment to an African American couple.

Guaranteed Rae to pay 15m over alleged FHA VA loan violations. Guaranteed Rate to pay 15 million to settle claims of FHA VA loan violations Accused of knowingly violating FHA VA loan rules April 29 2020 548 pm By Ben Lane Guaranteed Rate. An affiliated business arrangement is defined in section 3 7 of RESPA 12 USC.

If you have experienced discrimination in rental mortgage lending or in the provision of services file a complaint with the HUD Office of Fair Housing and Equal. Guaranteed Rate Inc. Federal Issues HUD Enforcement Fair Lending Discrimination Fair Housing Act.

Guaranteed Rae to pay 15m over alleged FHA VA loan violations. Thats what happened in the. The Real Estate Settlement Procedures Act RESPA is the federal statute that governs the mortgage servicing industry and protects your rights under the CARES Act.

Verifying Borrower Identity National Association Of Mortgage Underwriters Namu

Cdata Jpmorgan Chase Co 2012 Investor Day Presentation Slides

Fha Credit Requirements For 2022 Fha Lenders

New Fha Guidelines 2019 Fha Loan Guidelines Credit Score And More

Suddenly Here Comes The Inventory Homes Listed For Sale Jump Amid Price Reductions And Sagging Sales Wolf Street

Over 15 Offers And Still Rejected The Truth About Fha Loans Youtube

Mortgage Resume Samples Velvet Jobs

Phcuryw07g5yjm

Sellers Don T Like Fha Loans Mortgage Specialists

The Real Estate Book New Home Guide Greater Kansas City By Rhythm Media Llc Issuu

Originate Report September 2020 By Originate Report Issuu

128 Ranchway Burleson Tx 76028 Compass

Sellers Don T Like Fha Loans Mortgage Specialists

Fha Loans Everything You Need To Know

A Guide To First Time Home Buyer Programs Loans Rocket Mortgage

Fha Guidelines 2019 Changes Ovm Financial Mortgage News

Consumers Can Handle Fed Tightening Their Debts Delinquencies Foreclosures Collections And Bankruptcies Wolf Street